Annuity, Life, & Retirement Protection Specialist Kirk Kanenbley

With all of the different life insurance and retirement protection options available, it can be time consuming and overwhelming to figure out what to choose. What I do is help you find the solutions that would work best for you.

Life Insurance Types Guide

Explaining the Different Types of Life Insurance

You can watch a summary video below, read through a detailed guide, and get questions answered when you've finished.

Watch

For more information...

The Life Insurance Types Guide is below.

Financial Security Explained: Your Guide to Life Insurance & Annuity Products

Introduction

Are you confused by all the options when it comes to life insurance and financial protection?

If you are, you’re not alone.

From temporary coverage to lifetime wealth strategies, choosing the right tool is the key to securing your family's future.

We're breaking down six popular options so you can choose with confidence. Let’s dive in.

Final Expense or Burial Insurance.

This is a type of whole life policy with a smaller death benefit, usually five to fifty thousand dollars.

Its purpose is simple: to cover final expenses like funerals or medical bills, ensuring your family doesn't face that burden. 4It’s easy to qualify for, even if you’re older or less healthy.

Accidental Only Life Insurance

This only pays a benefit if death is the direct result of a covered accident.

It is not a substitute for standard life insurance.

It’s very low cost and is often used as a supplement or for those who cannot qualify for anything else.

Term Life Insurance

This is pure protection for a specific period—like 10, 20, or 30 years.

If you pass away during that term, your beneficiaries get the payout.

It’s the most affordable way to cover major temporary debts like a mortgage or income replacement while your kids are young.

Whole Life Insurance

This is permanent, lifetime coverage.

Your premiums are fixed, and the death benefit is guaranteed.

Crucially, it includes a guaranteed cash value that grows tax-deferred over time.

It’s a powerful tool for estate planning and passing on wealth.

Indexed Universal Life, or IUL

An IUL gives you permanent coverage with cash value growth linked to a stock market index, like the S&P 500.

This offers potential growth while a guaranteed "floor" protects you from market losses.

It’s commonly used for supplemental retirement income, leveraging tax advantages.

Indexed Annuities

Note: this is a retirement savings product, not life insurance.

It guarantees your principal while your interest earnings are tied to a market index.

The key benefit is principal protection 40and the ability to convert your savings into a guaranteed income stream you cannot outlive.

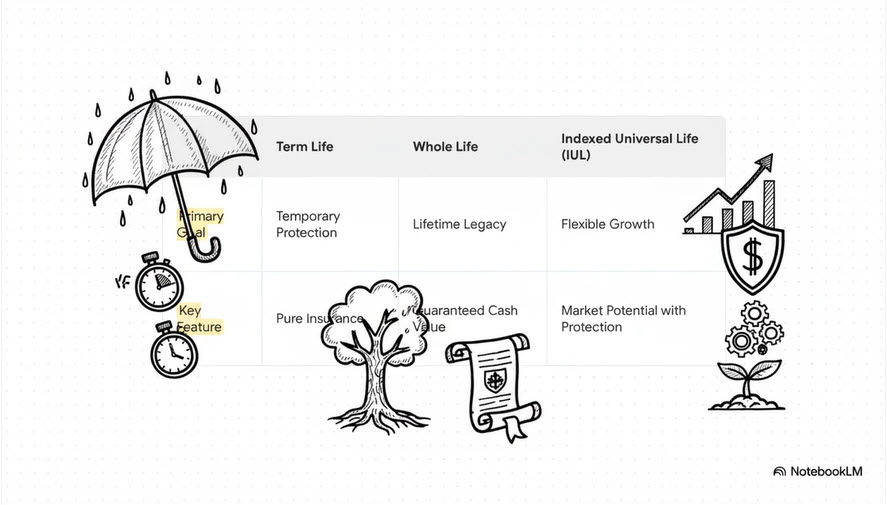

So, how do they compare?

Term Life is the most affordable.

Whole Life offers guaranteed cash value.

IUL provides market upside potential without the downside risk.

Your choice depends entirely on your specific goals, budget, and stage of life.

We specialize in creating clear, confident financial plans.

Click the link below to schedule your complimentary 15-minute consultation.

We’ll help you identify the most cost-effective solution for your protection and legacy goals.

Kirk Kanenbley

California Life & Health License 0M67527

Office: (909) 498-4822

Direct: Call / Text (909) 706-5737

With all of the different life insurance and retirement protection options available, it can be time consuming and overwhelming to figure out what to choose.

What I do is help you find the solutions that would

work best for you.

We are more than just financial professionals – we are committed to making a meaningful difference in the lives of our Clients. With years of experience and a passion for the making a difference in the lives of our clients, our team looks at every new client as a new member of our family.

With all of the different life insurance and retirement protection options available, it can be time consuming and overwhelming to figure out what to choose. What I do is help you find the solutions that would work best for you.

Contact Kirk Kanenbley

Calif. Life & Health License # 0M67527

Texas Life & Health License # 3165450

Facebook

Instagram

X

LinkedIn