Annuity, Life, & Retirement Protection Specialist Kirk Kanenbley

With all of the different life insurance and retirement protection options available, it can be time consuming and overwhelming to figure out what to choose. What I do is help you find the solutions that would work best for you.

Indexed Universal Life (IUL)

How IUL's Work, How They Can Protect Your Savings, and Increasing Your Cash Flow in Retirement

You can watch a summary video below, read through a detailed guide, and get questions answered when you've finished.

Watch

For more information...

Read the IULguide below.

How IUL's Work, How They Can Protect Your Savings, and How They Can Increase Your Cash Flow in Retirement

Unlock Your Policy's Full Potential

In today's complex financial world, finding a single solution that offers both protection and potential growth can feel like searching for a needle in a haystack.

Many people are looking beyond traditional savings accounts and volatile investment markets for strategies that offer more control and peace of mind.

This guide will introduce you to Indexed Universal Life (IUL) insurance, a financial product gaining popularity for its unique blend of death benefit protection, cash value growth potential linked to market indices, and tax advantages.

What is Indexed Universal Life (IUL) Insurance?

At its core, an IUL policy is a type of permanent life insurance. This means it provides coverage for your entire life, as long as premiums are paid.

What sets it apart is how its cash value grows.

Unlike Whole Life insurance, where cash value earns a fixed interest rate, or Variable Universal Life, where cash value is directly invested in sub-accounts, an IUL's cash value growth is tied to the performance of a market index (like the S&P 500), but with important safeguards.

Why People Choose IULs: The Key Benefits

Many individuals and families are drawn to IUL policies for a compelling set of advantages:

1. Potential for Tax-Deferred Cash Value Growth: The cash value in an IUL policy grows tax-deferred. This means you don't pay taxes on the growth until you withdraw it, allowing your money to compound more efficiently over time.

2. Protection Against Market Loss (Floor): This is a major differentiator! While your cash value is linked to market indices, IULs typically come with a "floor," often 0% or 1%.

This means that even if the linked index performs negatively, your cash value won't lose money due to market downturns. You participate in the upside, but are protected from the downside.

3. Access to Cash Value (Tax-Free Loans): You can access your policy's cash value through loans or withdrawals.

Policy loans are generally income tax-free, as long as the policy remains in force. This can provide a valuable source of funds for emergencies, college tuition, or retirement income, without liquidating other assets.

4. Death Benefit Protection: First and foremost, an IUL is life insurance.

It provides a death benefit to your beneficiaries, offering financial security and peace of mind for your loved ones.

This benefit is typically income tax-free to the beneficiaries.

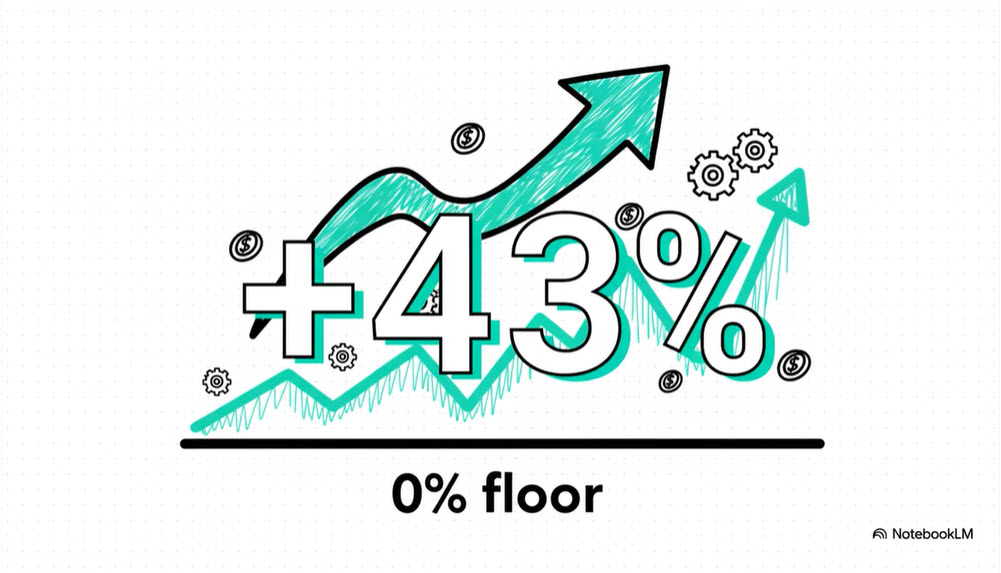

The Power of the "Floor": Winning by Not Losing

One of the most compelling features of an IUL is its "0% floor." But what does this really mean for your money?

It's simple: you participate in market-linked gains, but you are protected from market losses.

When you invest directly in the market, your money is on a rollercoaster.

When the market crashes, your account value drops, and you have to regain all that lost ground just to get back to where you started.

Consider the math of a loss:

If your $100,000 investment loses 30%, your value drops to $70,000.

You now need a 43% gain on that $70,000 just to get back to your original $100,000.

An IUL with a 0% floor changes this dynamic completely. During a down market year, your cash value is simply credited 0%.

You don't lose anything. You don't go backward.

The next year, when the market recovers, your policy captures gains from its stable value, not from the bottom of a hole.

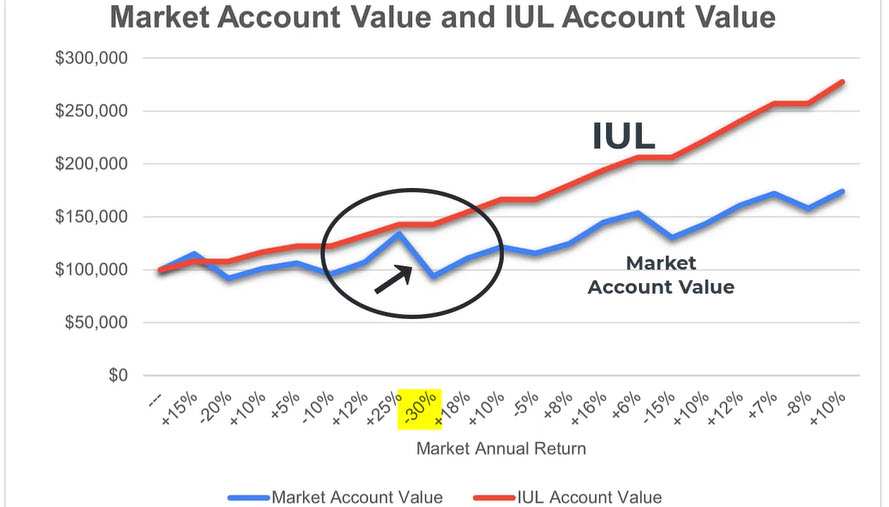

A Real-World Example: The "Zero vs. Hero" Chart

Let's compare the performance of $100,000 in a direct market investment versus an IUL policy, starting just before the 2008 financial crisis.

The "Market Investment" (Blue Line):

As you can see, the market investment is volatile. In Year 8, it suffered a 30% loss, and it took several years just to get back to where it was. These 'negative' years dramatically slow down your long-term growth."

The "IUL Policy" (Red Line): Now, look at the IUL. In those same down years (like Year 8), the policy didn't lose a penny. It simply stayed flat. This is the 0% floor protecting your money. Then, in the good years, it captured gains up to its cap.

The Result: By simply avoiding the losses, the IUL's cash value was able to compound on a stable, uninterrupted basis.

Even though its gains were capped in the big 'up' years, it still ended up with over $100,000 more because it never had to 'dig itself out of a hole.'

This is the power of 'winning by not losing.'"

Taxes and Leaving a Legacy for Your Family

An IUL is first and foremost a life insurance contract, which means the cash value can grow on a tax-deferred basis and, if structured correctly, be accessed later through policy loans, tax-free, for retirement income.

For those of you in the accumulation phase—especially those concerned about high California state taxes—this can be a powerful tax diversification strategy that traditional retirement accounts simply cannot match.

Being a life insurance policy, you have a death benefit which will go to your family or beneficiary. Life insurance death benefits typically pay out tax free. This is one of the ways wealth is created and transferred in a family.

Understanding the Considerations: Potential Downsides of IULs

While IULs offer significant benefits, it's crucial to understand their complexities and potential drawbacks:

1. Caps on Upside Potential:

To offer the market downside protection, IUL policies typically have a "cap rate" on how much interest your cash value can earn in a given year, even if the linked index performs exceptionally well.

This means your growth might be limited during boom markets.

2. Fees and Charges:

IUL policies, like other permanent life insurance products, come with various fees and charges.

These can include administrative fees, cost of insurance (COI) charges, and surrender charges if you cancel the policy early. These fees can impact your overall cash value growth, especially in the early years.

Being a life insurance policy is a big part of the reason you fit the tax guidelines that allow you pull money out using policy loans instead of taxable withdrawals.

That makes a huge difference when you are pulling out money in retirement and don’t have to pull more to cover taxes, like you do with a 401k.

3. Complexity:

IULs are more complex than simpler financial products.

Understanding how indexing strategies, participation rates, cap rates, and floors work is essential. It requires careful explanation and ongoing review to ensure the policy meets your evolving needs.

Is an IUL Right for You?

IULs can be a powerful financial tool for those seeking:

Long-term death benefit protection.

Cash value growth potential linked to market indices, but with protection against market losses.

Tax-advantaged growth and access to funds.

Flexibility in premium payments and death benefit amounts.

You can easily see how an IUL could work for You

The only way to truly see how this financial instrument performs is through a personal, non-binding illustration.

I can create a detailed illustration for you, based on what is realistic for you to put aside to save, so you can see the power of that principal protection on your future cash value.

I'll customize the premium, the index strategy, and the death benefit to align exactly with your goals.

We’ll also talk about the living benefits in the policy, which help protect you financially in case of a chronic or critical illness. This can provide you with a lump sum payout to help cover your bills at a difficult time, when you get hit with high medical bills or just need other help.

Contact Us if you have any questions or you would like to get your own personalized IUL illustration.

Kirk Kanenbley

California Life & Health License 0M67527

Office: (909) 498-4822

Direct: Call / Text (909) 706-5737

With all of the different life insurance and retirement protection options available, it can be time consuming and overwhelming to figure out what to choose.

What I do is help you find the solutions that would

work best for you.

We are more than just financial professionals – we are committed to making a meaningful difference in the lives of our Clients. With years of experience and a passion for the making a difference in the lives of our clients, our team looks at every new client as a new member of our family.

With all of the different life insurance and retirement protection options available, it can be time consuming and overwhelming to figure out what to choose. What I do is help you find the solutions that would work best for you.

Contact Kirk Kanenbley

Calif. Life & Health License # 0M67527

Texas Life & Health License # 3165450

Facebook

Instagram

X

LinkedIn