Annuity, Life, & Retirement Protection Specialist Kirk Kanenbley

With all of the different life insurance and retirement protection options available, it can be time consuming and overwhelming to figure out what to choose. What I do is help you find the solutions that would work best for you.

Read the Indexed Annuity Guide below.

Learn How You Can Protect Your Retirement Accounts From Loss or Risk & Create a Lifetime Income You Can Depend On.

Introduction

Planning for retirement can feel overwhelming. With taxes, inflation, healthcare costs, and stock market ups and downs, many seniors worry about running out of money.

Indexed annuities are designed to help.

They combine safety, growth, and guaranteed income—all in one product. This guide will explain how indexed annuities work, their benefits, and why they have become a foundation for retirement planning for millions of Americans.

Biggest Concerns of Retirees

Outliving your money – Will your savings last as long as you do? People are living longer than ever, and retirement may now last 20–30 years.

Safety – Can you count on your money being there when you need it? Market downturns can quickly wipe out savings.

Taxes – Are you losing too much of your retirement income to the IRS? Many retirees donʼt realize their Social Security benefits can also be taxed.

Inflation–How will you keep up with rising costs of food, housing, and health care over time?

Why People Choose Annuities

After considering these challenges, many retirees begin searching for solutions that provide both peace of mind and financial security.

This is where annuities often come into the picture.

People choose annuities because they:

Want guaranteed income they cannot outlive.

Prefer safety and stability instead of taking risks in the stock market.

Need predictable income to cover everyday expenses, healthcare, and housing.

Value products that are regulated, time-tested, and backed by insurance companies.

For these reasons, annuities have become a trusted option for those who want to enjoy retirement without constant financial worry.

How Indexed Annuities Work

Indexed annuities are financial products offered by insurance companies.

Hereʼs how they work:

You put money into an annuity contract with an insurance company.

The insurance company protects your money from market losses while giving you interest credits linked to a stock market index (such as the S&P 500 for example).

You benefit from part of the marketʼs growth and never lose money when the market goes down.

These products are provided by state-regulated insurance companies, which are required to maintain financial reserves and follow strict consumer protection rules.

Many indexed annuities also offer options for lifetime income riders, allowing you to turn your savings into guaranteed paychecks for life.

For these reasons, annuities have become a trusted option for those who want to enjoy retirement without constant financial worry.

Why Indexed Annuities Work

Indexed annuities are built to address retirement worries.

They offer:

Principal protection—you will never lose money when the market goes down.

Growth potential—earn interest linked to stock market indexes, like the S&P 500, without risking your principal.

Tax deferral—earnings grow tax-deferred until you take them out, which may lower your current taxes.

Guaranteed lifetime income—turn your savings into a paycheck for life, with options to cover a spouse as well.

Probate protection—your money goes directly to your loved ones, avoiding delays and expenses.

Flexibility—many contracts allow access to funds in emergencies, giving peace of mind.

For these reasons, annuities have become a trusted option for those who want to enjoy retirement without constant financial worry.

Lifetime Income Riders: Paychecks for Life

A Lifetime Income rider is an option you can add to many indexed annuities.

It guarantees you a monthly check for as long as you live—even if your account balance runs out.

This removes the fear of outliving your money.

A steady monthly income you cannot outlive, no matter how long you live.

Payments that can continue for your spouse after your death, providing financial security for both partners.

Flexibility to turn on income when you need it most, such as later in retirement when healthcare costs may rise.

Protection against longevity risk—even if you live into your 90s or beyond, your income will never stop.

The Long History of Annuities

Annuities are not new. They have been around for centuries. In fact, annuities were used as far back as the Roman Empire to provide lifetime payments to soldiers and their families.

In the United States, annuities have been issued since the early 1800s.

Today, millions of Americans use them as a safe and reliable retirement tool. This long history shows that annuities are a time-tested way to protect savings and provide a guaranteed Lifetime Income.

How Annuities Can Help with Social Security & Taxes

Many retirees are surprised to learn that up to 85% of their Social Security can be taxed. By moving certain assets into a tax-deferred annuity, you can lower the income that triggers those taxes—which means keeping more of your Social Security check in your pocket. This strategy can save thousands of dollars over the course of retirement and provide a more efficient income plan.

A Real-Life Use Story

A retired couple needed more income. By using an indexed annuity, they were able to significantly improve their retirement:

Boost their monthly income by 25%.

Pay less in taxes every quarter thanks to tax deferral.

Lock in a lifetime paycheck with an income rider.

Most importantly, they gained peace of mind knowing they would never outlive their money.

The Power of Indexed Annuities

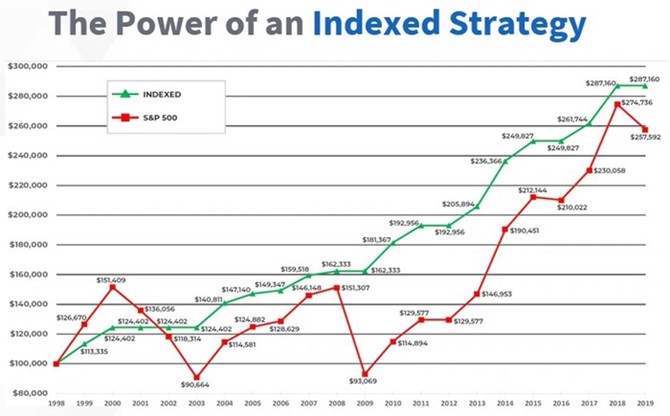

Below you will see an illustrated example of how an Indexed Annuity works:

Your entire principal is safe, and gains are locked in every year.

No downside risk, even in down years.

Lock in gains safely, without the stress of losing your principal.

Most importantly, clients gain peace of mind knowing they will never lose any of their hard earned money.

The Green Line represents an Indexed Annuity, and the Red Line represents traditional investments, such as a 401k, stocks, mutual funds, etc.

And as illustrated below, the GREEN Line never goes down.

Which line would you rather have your retirement follow?

These are just some of the reasons why so many individuals are choosing Indexed Annuities to safeguard their retirements: Safety • Growth • Income • Guarantees

You can easily see how an Indexed Annuity could work for You

Below you will see a sample page from an Annuity illustration.

Illustrations are used to show you a personalized plan based on the options you choose to take advantage of.

This lets you get an idea of what you might accomplish with safety in growth and longevity.

Your illustration can also be run to show you how much you could receive in a lifetime income stream, that you can count on. This is just one of several pages in an illustration.

Annuities are not just for when you retire. Many take advantage of them today with after tax money they want to save long term.

Annuities are also a great way to stop losing money in a 401k from a previous job.

Some Annuity companies give you a bonus of up to 10-20% when you open your account to accelerate your growth. (This is what we’re currently seeing as of October 2025)

The best way to see what your own annuity could do for you, is to contact us to request an illustration. Our contact information is below.

Final Thoughts

Indexed annuities are simple, safe, and designed for seniors or any individual who wants peace of mind.

They protect your savings, grow your money, reduce taxes, and can give you income for life.

With a long history of providing security and oversight from state-regulated insurance companies, they remain one of the most trusted retirement tools available today.

We Are Here to Help Guide You

We help educate individuals on all the different retirement options, and we can help guide you through the process of maximizing your retirement to its fullest.

Simply reach out to your Retirement Protection Advisor using the information below, for your own personalized review.

Contact Us if you have any questions or you would like to get your own personalized Annuity Illustration.

Kirk Kanenbley

California Life & Health License 0M67527

Office: (909) 498-4822

Direct: Call / Text (909) 706-5737

With all of the different life insurance and retirement protection options available, it can be time consuming and overwhelming to figure out what to choose.

What I do is help you find the solutions that would

work best for you.

We are more than just financial professionals – we are committed to making a meaningful difference in the lives of our Clients. With years of experience and a passion for the making a difference in the lives of our clients, our team looks at every new client as a new member of our family.

With all of the different life insurance and retirement protection options available, it can be time consuming and overwhelming to figure out what to choose. What I do is help you find the solutions that would work best for you.

Contact Kirk Kanenbley

Calif. Life & Health License # 0M67527

Texas Life & Health License # 3165450

Facebook

Instagram

X

LinkedIn